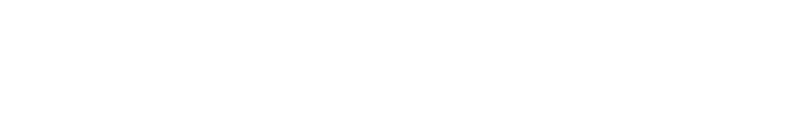

Recipients of the $272m funnelled through special accounts called ‘donor advised funds’ (DAFs) in the four tax years from 2017 to 2020 included at least two US groups linked to the political organising in Uganda that preceded its brutal ‘kill the gays’ law, as well as groups that have argued for the statutory castration of transgender people in Europe and been implicated in anti-LGBTIQ ‘conversion therapy’ even in US states where the practice is restricted.

Anonymity makes it impossible for campaigners to understand where the money that bankrolls anti-rights groups ultimately comes from, and frustrates their efforts to hold backers accountable or persuade them away from funding hate.

openDemocracy scraped and analysed data on nearly 2,000 US funders to investigate money flows to a set of 36 American far-right groups that work to restrict the rights of women and LGBTIQ people. They include four organisations that the Southern Poverty Law Center has labelled hate groups, two that partner with these hate groups, and 30 others that openDemocracy has tracked for years. This initial analysis found that 12 DAF operators accounted for half of the money that these far-right groups got from US philanthropy.

We closely reviewed more than 15,000 pages of grant reports that the 12 biggest DAF operators filed with US tax authorities. According to these documents, the operators gave the 36 groups more than 600 grants from 2017 to 2020, the most recent year available for examination.

More than 40% ($113m) of the DAF funds tracked by openDemocracy went to four groups that are designated as anti-LGBTIQ hate groups by the Southern Poverty Law Centre (SPLC): Alliance Defending Freedom (ADF), Family Research Council (FRC), Family Watch International (FWI), and Liberty Counsel.

Tax breaks

A donor-advised fund is an account that an organisation, a family, or individuals can open with a US non-profit for the purpose of managing charitable donations. These funds offer significant US tax breaks for a donor, as well as – crucially – a structure that shields them from any controversy stirred up by their intended recipients.

This is important because charitable donations in the US are otherwise publicly visible upon request through tax filings. In other words, if you are a billionaire who wants to give to a group that is in the news for fighting trans people but you don’t want to be publicly associated with the controversy, you open a DAF with an organisation registered as a US non-profit and channel that donation through it.

Critics of the system, however, say such dark money flows from donor-advised funds are a threat to human rights and justice, much like the tsunamis of anonymous money that prop up the US political campaign system.

That anonymity “works very much to the benefit of people who want to hide who they're giving money to,” especially for those backing groups increasingly under the spotlight for fueling disinformation, hate speech and violence, says Heidi Beirich of the Global Project Against Hate and Extremism.

The use of DAFs as a channel for philanthropy in the US has grown massively in recent decades. Each of the 12 DAF operators examined in this investigation receives more than $1bn (the equivalent of about £790m) a year.

Funding hate by design

One of the groups receiving cash through DAFs, Family Watch International, was recently linked to the political organising that set the stage for Uganda’s so-called ‘kill the gays’ law, passed this year as the Anti-Homosexuality Act 2023. A 2020 openDemocracy investigation found that the group had been coaching high-level African politicians to campaign against sex education and LGBTIQ rights. About 6% of its $2.9m revenue from 2017 to 2020 was channelled through DAFs. Another group linked to the Uganda “kill the gays” law, the Fellowship Foundation, got more than $12.8m, nearly a quarter of its revenue in this period, via DAFs.

The Alliance Defending Freedom, which got 43% of its revenue during this period through the 12 DAF operators we examined for this investigation, is best known for its legal battles against LGBTIQ and abortion rights. It boasts of having been part of the legal team that argued successfully before the US Supreme Court for the removal of federal protection for abortion rights, having first helped Mississippi politicians back in 2018 to draft the law that would end up at the centre of the challenge to Roe v Wade.

It has been credited by conservative US lawmakers for drafting laws to ban trans athletes from sport – such as Idaho’s ‘HB500’ bill. Its lawyers have argued for the right of some businesses to discriminate against LGBTIQ people, notably in the US Supreme Court on behalf of the Colorado cake shop that refused to bake a wedding cake for a same-sex couple. ADF lawyers have also filed lawsuits to bar transgender high schoolers from sports.

The ADF’s international arm has been active in European courts, too. In 2015, for instance, it filed a brief to the European Court of Human Rights, arguing for the retention of laws requiring trans people to be sterilised before they could legally change their gender on official documents. This intervention contributed to ADF’s subsequent designation as an anti-LGBTIQ hate group by the Southern Poverty Law Centre, a prominent US civil rights organisation.

Top DAF operators also gave $2.6m to two groups that collaborate with the ADF – the American Legislative Exchange Council (ALEC) and Advocates International.

Just over half of the funds tracked in this investigation came through two DAF operators called DonorsTrust and the National Christian Charitable Foundation (NCF), both of which are described by US philanthropy insiders as specifically set up to handle money for philanthropists with conservative political or social views.

A fifth of the funds tracked by oD were channelled through a DAF operator linked to the NCF called Servant Foundation, which has seen staggering growth in recent years. The little known pass-through charity used to receive $3m to $4m in contributions a year but in 2019 this figure shot to more than $1bn, including more than $307m it received from the NCF itself.

NCF and the Servant Foundation did not respond to openDemocracy’s requests for comment.

‘Right to express themselves’

Once someone deposits money into a donor-advised fund, US charity law treats the funds as belonging to the DAF operator itself. This means the donor gets an immediate tax break for charitable giving even if the money has yet to be passed on to its ultimate recipient.

In principle, this means DAF operators could veto donors’ recommendations about which groups their money gets given to – hence the non-committal words ‘donor advised’. In reality, though, DAF operators rarely use this power.

Smaller DAF operators, like Chicago Community Trust, have refused to pass money to groups identified as engaging in hateful activities.

Others, including DonorsTrust, vigorously support their depositors’ right to donate to whomever they choose, no matter the destination. “DonorsTrust is committed to safeguarding our account-holders’ right to express themselves through their charitable giving,” Lawson Bader, president and CEO of the Virginia-based DAF operator told openDemocracy. “We also do not presume to know what motivates a donor to recommend a grant in the first place.

“It’s unfortunate people cherrypick causes with which they may disagree and subsequently demonise those who may hold different beliefs or opinions about, for example, abortion.”

DonorsTrust sent small amounts to two organisations the SPLC designates as hate groups, Liberty Counsel and ADF, and nearly $2m to ALEC, which collaborates with the latter. It also sent more than $18.5m to a group that has been described as the “conservative pipeline to the US Supreme Court” and “architects of American dystopia”: the Federalist Society.

Financial incentives

As well as ideological concerns, there are financial incentives for DAF operators to stick to their depositors’ wishes about where to donate cash.

More than a fifth of the funds tracked in this investigation, including over $8.6m that went to SPLC-defined ‘hate groups’, was channelled through DAFs managed by non-profit organisations linked to Wall Street investment banks: Fidelity, Schwab, Vanguard, Morgan Stanley and Goldman Sachs.

Before transferring donors’ cash to recipients, these firms invest it with their parent companies, making them millions in fees.

For example, in 2020, Fidelity Charitable paid its parent firm, Fidelity Investments, more than $94m for investment management services.

The DAF operators also make millions directly – in the financial year ending June 2021, Fidelity Charitable netted more than $146m by charging depositors administrative, investment management and professional fees.

With that much money at stake, DAF operators are keen to keep their depositors happy and returning, regardless of the cost to human rights or marginalised groups, according to Alan Cantor, a consultant to non-profit organisations in New Hampshire. He criticises laws governing DAFs as “the Wall Street takeover of charity”.

In statements sent to openDemocracy and elsewhere, DAF operators affiliated with investment firms justified their philosophy as “cause-neutral” – a claim given short shrift by some.

“Money is never cause-neutral,” said Mark Hurtubise, the former president of the US non-profit Inland Northwest Community Foundation, who witnessed a supposedly ‘cause-neutral’ DAF operator financing a white nationalist group.

Crucially, he argues, what some of these non-profits espouse does not meet the “charitable purpose” definition to justify being classified as a charity by US authorities.

“What compounds the challenge,” he added, “is the structure of DAFs means the actual donors remain anonymous to authorities, journalists and potentially the [groups] themselves.”

Hurtubise says that this opacity has made DAF operators the “hidden underbelly of US philanthropy” that has “been allowed to pollute the noble intentions” of US charitable giving.